richmond property tax rate

Parking Violations Online Payment. 3 Road Richmond British Columbia V6Y 2C1 Hours.

About Your Tax Bill City Of Richmond Hill

City of Richmond adopted a tax rate.

. Property Taxes Due 2021 property tax bills were due as of November 15 2021. Tax Sales Next Tax Sale is scheduled for Tuesday September 1st 2022. Municipal Finance Authority 250-383-1181 Victoria Property Assessments.

Ad Public Richmond Property Records Can Reveal Mortgages Taxes Liens and Much More. Vehicle License Tax Motorcycles. Search Richmond Records Online - Results In Minutes.

Car Tax Credit -PPTR. Vehicle License Tax Vehicles. The following video provides a simplified explanation of the relationship between your assessment value and your property taxes.

107 rows Richmonds real estate tax rate is 120 per 100 of assessed value. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. These are a few of the public services nearly all local governments ordinarily support.

The real estate tax rate is 120 per 100 of the properties assessed value. Personal Property Taxes are billed once a year with a December 5 th due date. Property taxes are the main source of funds for Richmond and the rest of local governmental units.

Personal Property Registration Form An ANNUAL. If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. 8152021 11152021 2152022 and 5162022.

Tax amount varies by county. Broad Street Richmond VA 23219. According to a release from the RCBOE.

The Town of Richmonds property tax due dates are as follows. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Rockingham NC 28379 Business.

The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. Maritza Salazar Created Date. WJBF The Richmond County School Board announced its intention to increase 2022 property taxes by 493 over the rollback millage rate.

What is considered real property. 074 of home value. Vagas Jackson Tax Administrator 1401 Fayetteville Rd.

Together with counties they all rely on real property tax receipts to support their operations. Real property consists of land buildings and. Vehicle License Tax Antique.

Such As Deeds Liens Property Tax More. The Richmond County School Board announced Thursday its intention to increase the 2022 property taxes it will levy this year by 493 over the rollback millage rate. 1 day agoRichmond County school board enacts tax hike with record-low millage.

Start Your Homeowner Search Today. These documents are provided in Adobe Acrobat PDF format for printing. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456.

Town Center Building 203 Bridge St PO Box 285 Richmond VT 05477. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Usually new assessments use an en masse strategy applied to all alike property in the same locality without individual property tours.

New to Richmond County. This tax payment portal can be. View more information about payment responsibility.

Search by Property Address Search property based on street address. Search Valuable Data On A Property. When the total digest of taxable property is prepared Georgia law requires a rollback millage rate must be computed that will produce the same total revenue on the current year.

652019 101518 AM. Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. For all who owned property on January 1 even if the property has been sold a tax bill will still be sent. Payments can be mailed to.

Richmond County Board of Education is reducing the property tax rate by 86 to 1765 mills the lowest its been in nearly 20 years officials said Thursday. June 5 and Dec. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

295 with a minimum of 100. Virginia is ranked number twenty one out of the fifty states in order of the average amount of property. The new assessments will be used to calculate tax bills mailed to city property owners next year.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Year Municipal Rate. Under the state Code reexaminations must occur at least once within a three-year timeframe.

Real Estate and Personal Property Taxes Online Payment. A 10 yearly tax hike is the maximum raise allowed on the capped properties. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond.

Ad Get In-Depth Property Tax Data In Minutes. Taxpayers may not feel much relief however as the lower millage competes with their rising property values. Building Department.

Property taxes are calculated based on the assessment values set by BC Assessment. Electronic Check ACHEFT 095. 1 day agoAUGUSTA Ga.

815 am to 500 pm Monday to Friday. 14 and June 14. Residential Property Tax Rate for Richmond from 2018 to 2021.

Vermont Property Tax Rates Nancy Jenkins Real Estate

Richmond Property Tax 2021 Calculator Rates Wowa Ca

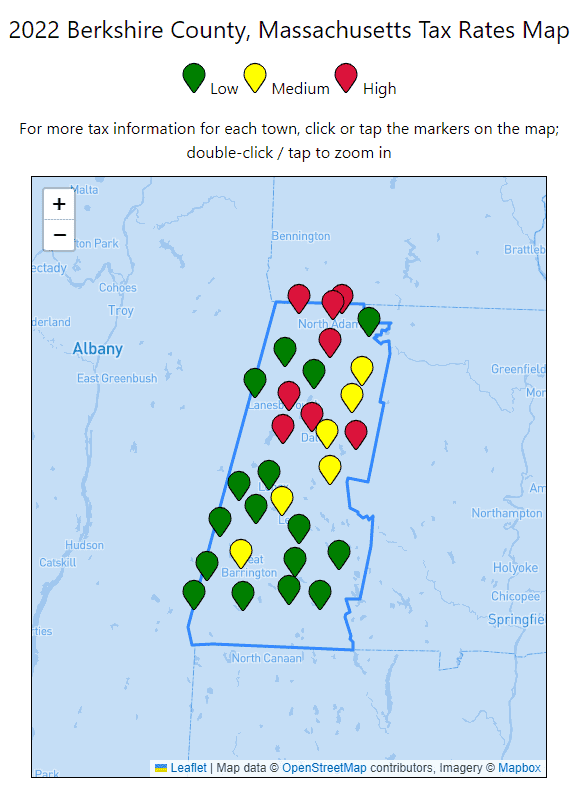

2022 Berkshire County Massachusetts Property Tax Rates Map Includes Pittsfield North Adams Adams Williamstown Etc

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

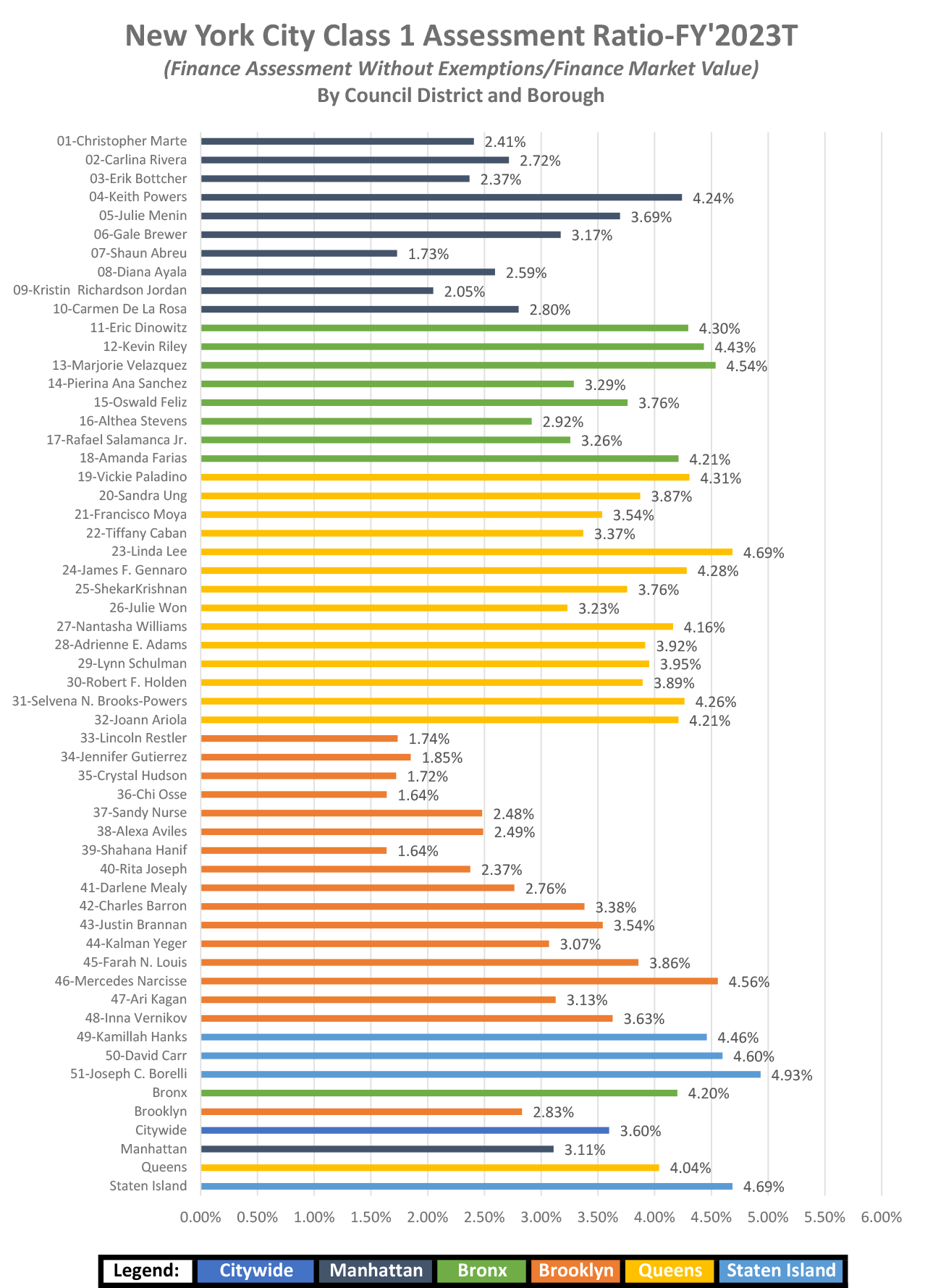

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

About Your Tax Bill City Of Richmond Hill

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

New York City Property Tax Rate Is It Worth Selling

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

About Your Tax Bill City Of Richmond Hill

Virginia Property Tax Calculator Smartasset

Fulshear Simonton Fire Department Proudly Serving Fort Bend County Esd No 4

Richmond Raises Tax Relief As Vehicle Values Surge Wric Abc 8news

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now